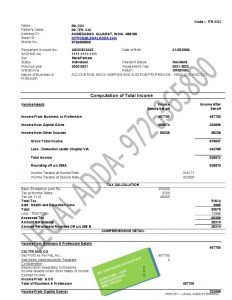

Income Tax Return Computation of Income (Get CA Certified COI)

Computation of Income Format

Are you looking for Computation of Income Format?

Check out Sample Copy of CoI. Let us know if you required CoI

Fill the form below

What does we include in Computation of Income?

Computation of Income is simply a summarized information of Income Tax Return Data. Computation of Income (CoI) Format includes Income Analysis from All five Source with calculation of Income, Deduction Details, Tax Calculation, Payment and TDS details, and Personal Information. Get CA Verified CoI Now.

1. Computation of Income (CoI) Without CA Certification

2. CoI and ITR CA Certified

> Bank Loan and Insurance Policy requires CoI Frequently. Also COI with Net worth Certificate while applying VISA is advisable.

Income Tax Computation Format

What We Include in Computation – Presentation of COI as Follows

A. General Details

- Name of Assessee: Mr. ABC

- PAN: AXRPG0000Z

- Financial Year: 2023-24

- Assessment Year: 2024-25

- Type of Return: 139- Regular/Revised

- ITR Form: 1/2/3/4/5/6

- Date of Birth: DD/MM/YYYY

- Income Tax Ward: ITO-X

- Country of Resident: India

- Audit under Section 44AB: NO

- Business Activity : If any

- Bank Details: Account & IFSC Code

B. Income Details

- Income From Salary

- Company Name

- TAN

- Gross Salary

- Exempt Portion

- Net Taxable Salary

- Income From House & Property

- Rent Income

- Interest on Home Loan (if any)

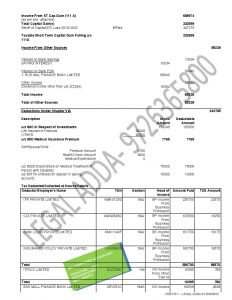

- Income From Capital Gain

- Sale Consideration

- Expenses

- Purchase Value

- Capital Gain – Short Term & Long Term

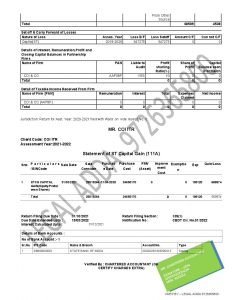

- Income From Business

- Turnover

- Expenses

- Profit (44AD)

- Business Name

- Profit & Loss Summary

- Income From Other Sources

- Interest Income

- Dividend

- Other Income

- Exempt Income

- Agriculture Income

- Gift

- PPF Interest

- Deductions Details

- 80C Deductions

- 80D Deductions

- Other Deductions as applicable

- Tax Calculation

- Tax Deductions (TDS)

- Advance & Self Assessment Tax Paid

- Refund/Payable of Tax

CA Certified – Sign & Seal of CA